Start with evaluating the money you owe, as well as your earnings, coupons, and you will expenditures. Envision exactly how much you can conveniently be able to spend on framework costs, and any additional expenditures eg it allows and you may fees. It is critical to become realistic and leave room to have unexpected costs that may arise within the structure procedure.

Such, if you intend to build a separate home, look into the mediocre cost for each sq ft close by in order to rating a sense of the possibility expenditures. From the precisely choosing your budget, you can be sure to commonly overextending oneself economically and you can raise your chances of obtaining a construction mortgage.

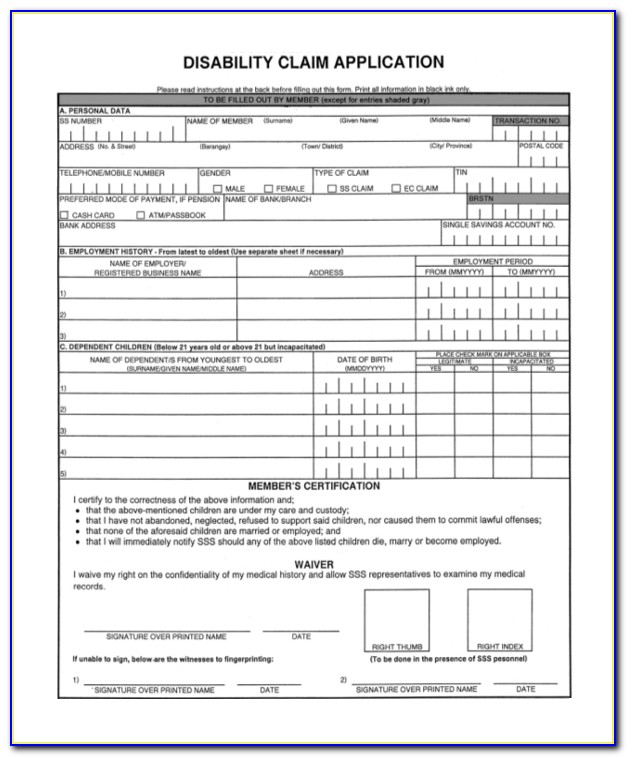

Get together Required Documents

When it comes to construction finance with Wells Fargo, collecting the desired records try an important step in the process. It normally includes data instance proof money, tax returns, financial comments, and you may facts about the development project by itself. Bringing these data files on time and accurately is extremely important to ensure a good effortless loan recognition techniques.

Eg, loan providers may consult data files like http://www.clickcashadvance.com/payday-loans-ia/hudson/ a houses offer, arrangements and you will needs, and cost breakdowns. From the on time gathering and entry the mandatory files, you could let facilitate the loan software and increase the odds of acceptance for the build endeavor.

Submission Your application

To submit your application to have a casing Loan having Wells Fargo, assemble every requisite documents such as your credit history, income confirmation, and you may construction arrangements. Render more information regarding the enterprise, such as the estimated will set you back and you can timelines. Expect you’ll respond to any extra questions regarding mortgage officer when you look at the review procedure. This step is crucial to decide your qualifications and you can measure the exposure with the mortgage.

Additionally, ensure that your software program is done and you can specific to cease people delays otherwise rejections. Submission a well-waiting and you may thorough application develops your odds of acquiring a houses Financing.

Loan Manager Remark

During the loan administrator comment processes to have Construction Financing Wells Fargo, that loan manager often view your loan software and you can financial records to choose your eligibility plus the amount your qualify for. They are going to assess situations such as your credit rating, income, therefore the feasibility of your own build investment. So it review assists the lending company understand the number of chance involved and you can implies that there is the methods to pay back the borrowed funds.

It is critical to render appropriate and you can over suggestions so you’re able to facilitate the fresh feedback techniques while increasing the probability of recognition. Working directly along with your mortgage manager and promptly addressing people demands for additional documents otherwise recommendations might help streamline the feedback processes.

Appraisal and you may Inspection

For the design financing procedure which have Wells Fargo, that extremely important step is the appraisal and you can assessment. An enthusiastic appraiser have a tendency to gauge the property value your home centered on issues instance place and you will possible resale well worth.

Simultaneously, an inspector often assess the design progress to ensure it meets security and you can high quality conditions. It is important to choose qualified experts who understand the novel pressures from structure ideas. The outcome of appraisal and you can inspection ount otherwise disbursement agenda, so it’s essential to target one activities promptly. Regular communication together with your loan manager and you may becoming current to your advances may help guarantee a soft assessment and inspection processes.

Closure and Disbursement

Closing and Disbursement ‘s the latest help getting a construction loan having Wells Fargo. When you look at the closing process, the necessary courtroom data is closed and you may one a good charges otherwise prices are compensated. Immediately following closure, the cash is paid to cover structure costs. It is very important very carefully comment all data and ensure reliability before signing. Due to the fact mortgage try closed, fast disbursement out-of money is essential having keeping the development endeavor on course.

0 Comments

Leave A Comment